We’ve generally considered it impossible for interest rates to go negative. But then they did. Rates on sovereign debt are negative in Japan, Germany, France and many other European countries. In Denmark, mortgage rates are negative 0.5 percent.

A closer look at why this happens makes clear that, while it’s unlikely, negative interest rates could happen in the US, causing little disruption to the mortgage finance system and possibly boosting home sales.

Why do interest rates sometimes go negative?

The short answer: when the supply of investment capital exceeds demand, long-term interest rates can go negative.

Because investors can always hold cash, which has an implicit interest rate of zero, traditional belief has held that interest rates cannot go negative. But it turns out that holding cash in large quantities isn’t practical.

Cash is costly to store ($1 billion in $100 dollar bills weighs more than 10 tons), there is the risk of loss from fire or theft, and there is only $1.5 trillion in circulation, compared with financial assets of $88.9 trillion. So investors with large quantities of cash need to find investment vehicles to park their money.

When there is little demand for this capital and enough supply from investors looking to invest it somewhere, real interest rates (i.e., interest rates adjusted for inflation) will go negative. In fact, they have gone negative in the US on several occasions, including this past summer.

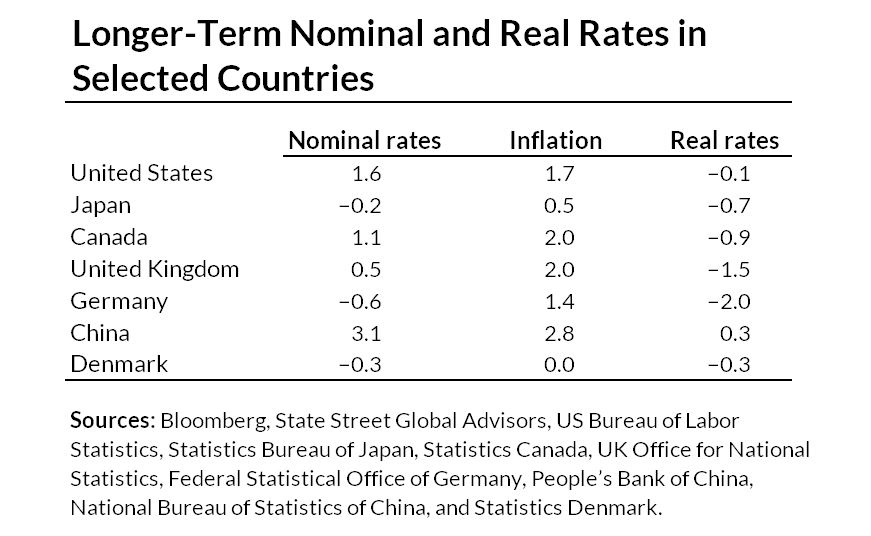

Using one measure of inflation, the 12-month change in the US Bureau of Labor Statistics’ Consumer Price Index (CPI) suggests that real long-term rates in the US may have recently dipped into negative territory. Over the past 12 months ending in August, the CPI increased 1.7 percent, greater than the average rate on the US 10-year Treasury note over August, 1.6 percent. In September, the 10-year Treasury note rate averaged 1.7 percent, on par with inflation.

Across Japan and parts of Europe, real interest rates and inflation are so low that nominal rates are negative as well, as shown in table 1. In these economies, the population is tilted toward those near or in retirement, with relatively fewer younger workers. The older population has savings they are looking to invest. But the younger population drives the demand for capital. Given this dynamic, rates on sovereign debt are negative.

It is important to realize that investors do not “make interest payments” on negative-yielding bond holdings. Instead, when investors buy a bond with a negative yield, they receive less back when the bond matures.

With a negative mortgage rate, the mortgage balance decreases by more than the monthly mortgage payment

In the US, rates on US Department of the Treasury securities remain positive, but negative rates are a possibility. Mortgage rates, however, tend to be higher than rates on sovereign debt because of credit and prepayment risks and costs of servicing.

Yet, even mortgage rates can go negative, as we have recently seen in Denmark. From a US perspective, negative mortgage rates would require a rate decrease by more than 350 basis points. But we have seen moves of this magnitude recently. For example, mortgage rates decreased by 300 basis points between 2007 and 2012.

So, although negative mortgage rates in the United States are unlikely, they are not impossible. A negative mortgage rate on a 30-year fixed-rate mortgage does not mean the homeowner receives a payment. Rather, the homeowner still makes a payment each month, but the balance owed decreases by an amount greater than the mortgage payment. A simple example on a $200,000 mortgage illustrates how a mortgage with a negative interest rate would work.

At a −1 percent mortgage rate, the homeowner’s monthly payment is $476.16, or $5,713.84 for the year. However, the amount owed after the year is $192,321.42, or a reduction of $7,678.58. The difference between what the homeowner paid and the reduction in the mortgage balance is $1,964.74, or a just a little less than 1 percent, which reflects the 1 percent payment to the homeowner on a slightly declining balance.

If rates go negative in the US, we expect little disruption and a possible increase in housing affordability

The long-term effects of negative mortgage rates should not be disruptive. Perhaps most importantly, the current infrastructure that delivers mortgage finance could handle negative rates, although some systems would need to be updated to accept negative rates. As the example above shows, the payments are still flowing from homebuyers to investors.

The infrastructure, or “pipes,” that support mortgage originations, securitization, and servicing are simply systems that allow data and cash to flow between the various parties. These pipes would not easily handle cash going from the investor to the homeowner, but this won’t happen.

Absent a large shock driving the US economy into a recession, negative mortgage rates would increase the demand for housing as the monthly payment would decrease. This would place slight upward pressure on house prices. But we don’t think the effect will be dramatic because the rate of home price appreciation has slowed and lower rates are apt to be accompanied by a weaker economy.

We would expect a dramatic increase in the refinancing of existing mortgages as rates decrease. In fact, we would expect prepayment rates even greater than what we experienced in 2003, when more than half of all mortgages refinanced.

Would homeowners make a smaller down payment to borrow more at low rates? We think not. If mortgage rates are negative, the rates that homeowners can get on their savings are likely to be even more negative. So there will be little incentive for the homeowner to take a larger mortgage (i.e., use more leverage).

Some other trends that we might expect:

- Debt-to-income ratios would decrease because monthly debt payments would be lower. But as we have pointed out, debt-to-income ratio is a weak predictor of risk in mortgage lending.

- Fees on mortgages would increase as originators look for noninterest items to preserve profitability. Analysis of the impact of negative policy rates in Europe reveals that a net share of Euro area banks increased their noninterest rate charges in response to the European Central Bank’s negative deposit facility rate.

Negative long-term interest rates exist in countries around the world, driven in large part by demographic shifts that have reduced the demand for capital while increasing its supply. Although mortgage rates in the United States remain positive, the rate on the 10-year Treasury note is now less than 2 percent, and political pressure for lower short-term rates has mounted.

Even if mortgage rates were to go negative, we believe it would not materially disrupt the housing finance system. Some software would need updating, but the structure of the system would not be altered.

A term in the title of the table was corrected from "real estate rates" to "real rates." Corrected 10/18/2019.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.