Homeownership is one of the most widespread and effective ways families can build intergenerational wealth. Though it is not the best option for everyone, evidence shows homeownership is still financially better than renting. But housing equity is not shared evenly. The homeownership gap between Black families and white families is wider today than it was in the 1960s, both because of structural barriers to homeownership and because the Great Recession, natural disasters, and COVID-19 have hit Black households hardest. Accordingly, changes in the homeownership rate in the coming decades will significantly affect the wealth-building capacity of US households—especially those who already face barriers.

For years, news stories have highlighted existing homeownership rates and predicted what next year’s market will bring. But in a new report, we quantify what homeownership rates will look like in the next two decades if current policies remain unchanged.

We estimate that by 2040, there will be 6.9 million additional homeowners. But at the same time, the national homeownership rate will decline 3 percentage points, from 65 percent to 62 percent. Though this may seem like a modest decline, it will have an enormous impact on each successive generation in their prime homebuying and equity-building years, especially Black millennials and Black seniors.

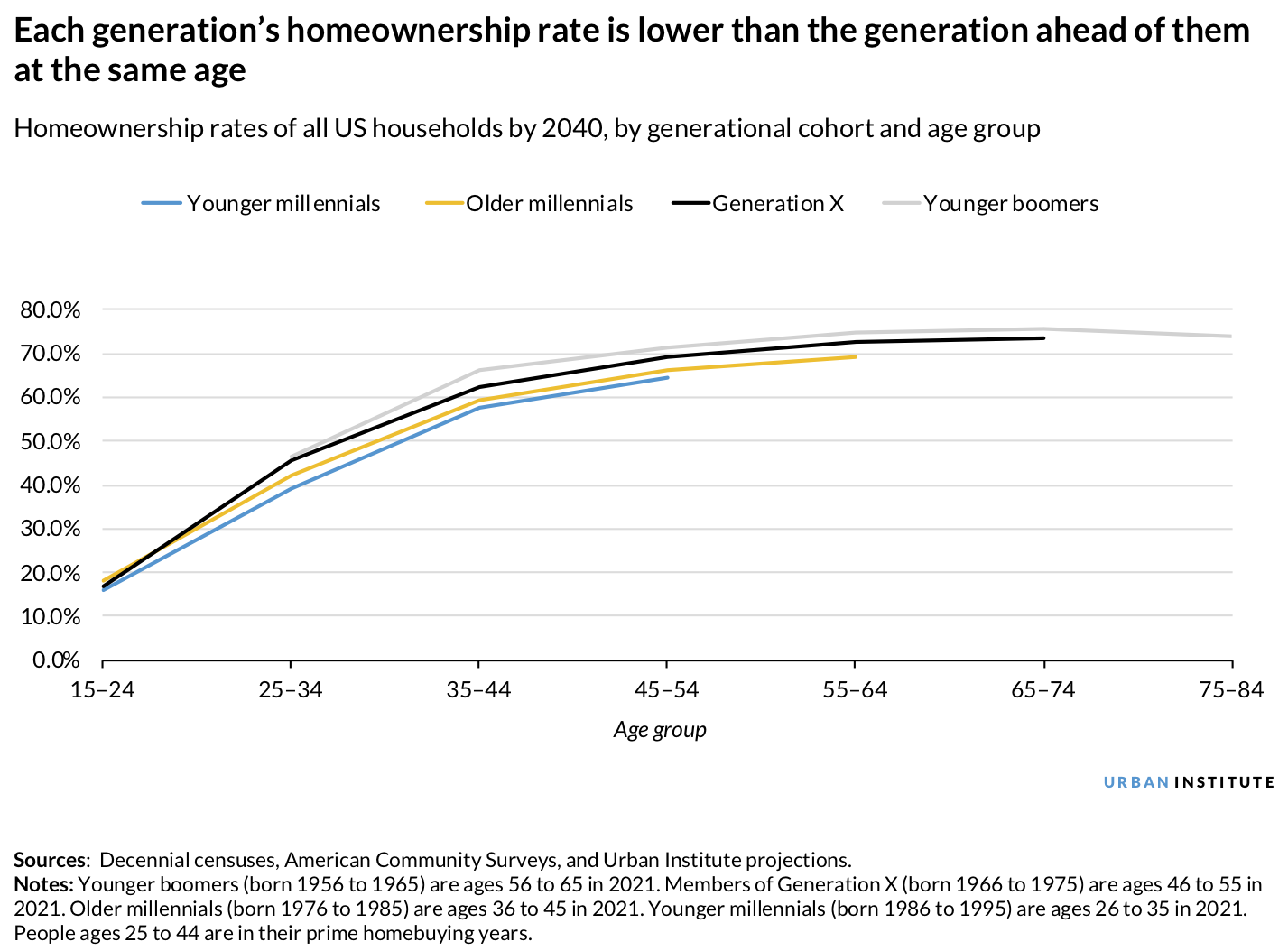

The homeownership rate has consistently declined with each generation since the boomers

The homeownership rate for each age group younger than 75 will decline dramatically over the next two decades, but the overall homeownership rate won’t reflect this. That’s because the rapid aging of our population will produce a higher share of homeowner-dominant senior households, so we’ll see only a modest decline in the overall homeownership rate. Importantly, however, each generation’s homeownership rate is lower than the generation ahead of them at the same age. By 2040,

- 34 percent of household heads will be 65 or older, compared with 27 percent in 2020 and just 22 percent in 1990;

- younger millennials, who will reach ages 45 to 54, will have a homeownership rate of 64 percent, versus 72 percent for younger boomers at the same age (an 8 percentage-point difference); and

- the homebuying rate in the prime homebuying years (ages 25 to 44) will decline by 6.5 to 9.0 percentage points between the boomers and younger generations.

If these trends continue, this snapshot of America in 2040 shows 87.1 million homeowners. If Generation X, older and younger millennials, and younger generations bought homes at the rate boomers bought homes throughout their lives, however, there would be 90.5 million homeowners by 2040. That’s 3.3 million fewer homeowners, or 3.3 million more renters who are not tapping into the wealth-building potential of homeownership.

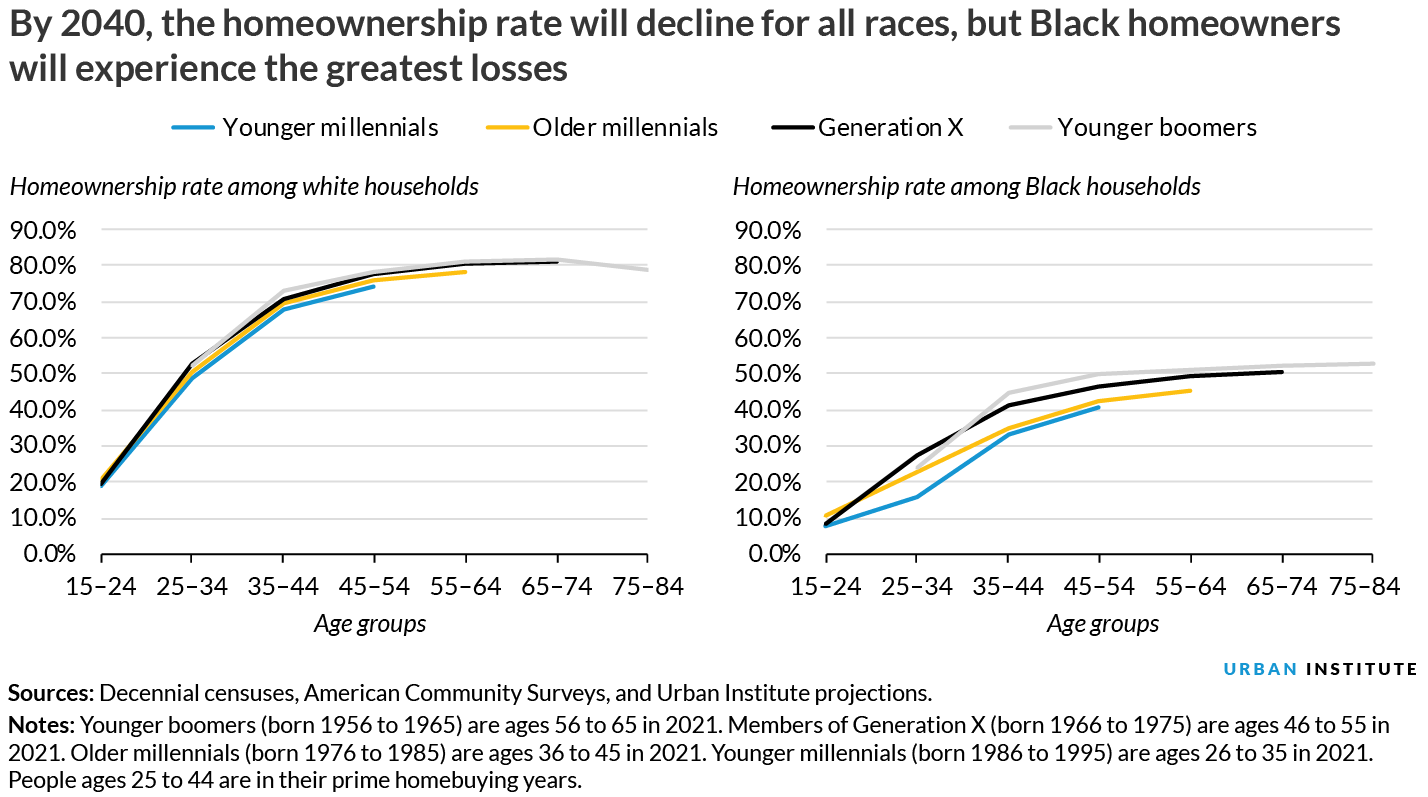

Homeownership will decline most for Black households in their prime homebuying and equity-building years

These shortfalls are not shared equally among different racial groups. Younger Black millennials, who will reach ages 45 to 54 in 2040, will have a homeownership rate of 41 percent, compared with the 50 percent homeownership rate among younger Black boomers at the same age—a 9 percentage-point difference. Meanwhile, younger white millennials who reach ages 45 to 54 in 2040 will have a homeownership rate that is only about 4 percentage points lower than it was for younger white boomers when they were the same age.

Although the absolute decline in homeowners is highest among white homeowners, the impact is the largest on Black households. If Black Generation X households, older Black households, younger Black millennials, and younger Black generations bought at the rate young Black boomers bought homes throughout their lives, there would be 8.5 million Black homeowners by 2040, instead of the projected 7.6 million. That is 900,000 households, or 12.4 percent of Black renter households, that will miss out on homeownership. Compared with the absolute number of Black homeowners, a 12.4 percent reduction in the number of white homeowners is 3.5 percent. For Asian and other households, the percentage is 4.1 percent, and for Hispanic households, it is 0.2 percent.

What comes next?

Our new projections reveal a modest decline in the overall homeownership rate by 2040, but they don’t tell the full story. Digging into the data shows a significant decline in the homeownership rate in the prime homebuying and equity-building years for all races and ethnicities. The impact on Black homeownership and implications for Black wealth building in the future are most dramatic.

But these projections are just a snapshot of what we’ll see if current policies continue for the next 20 years—a snapshot that policymakers can significantly alter through changes we know how to make today.

Increasing homeownership in Black communities requires improving and expanding financial education and homeownership preparation; increasing the visibility, access, and types of down payment assistance programs; and expanding financing options to meet the needs of different types of creditworthy borrowers. It also requires reexamining the ways borrowers qualify for mortgages and revamping the process to more precisely assess creditworthiness. Finally, implementing programs that sustain homeownership for low-wealth, disproportionately minority borrowers will be key.

As management gurus preach, the best way to predict the future is to create the future you want; 2040 could produce a brighter picture of homeownership and wealth for Black communities if policymakers act now.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.