Although every recession is different, the 2008 Great Recession and the pandemic-induced recession in 2020 have been strikingly so for student loan borrowers. Part of this difference is caused by changes in public policy, such as the current federal student loan pause, but it’s also caused by the increasingly broad range of student loan borrowers.

Compared with 2008, student loan borrowers today are older, carry more debt on average, are more likely to have middle or higher incomes, and benefit from more flexible student loan repayment policies. More than ever, federal student loan borrowers are not a monolith, and this has implications for how we build public policy for borrowers.

In recent work, we find that first-time mortgage lending rates during the pandemic were higher on average among student borrowers relative to nonborrowers. This finding contrasts with evidence from 2008 that suggested homebuying among borrowers slowed. Those who were in repayment on their student loans before the pandemic appeared more likely to take out first-time mortgages. Borrowers who were struggling—those in default on their student loan debt—were less likely than similarly positioned peers to obtain a new home loan.

The growth in federal student loan borrowing

The overall number of federal student loan borrowers increased by 43 percent between 2008 and 2020, and the average outstanding debt per borrower increased by 83 percent, from $19,300 to $35,400. This growth was likely spurred by increased enrollment in higher education during the 2008 recession and the introduction of the graduate PLUS loan in 2006, which replaced much of the private lending to graduate students.

This growth was not uniform; some groups increased their borrowing rates (and borrowing amounts) more than others.

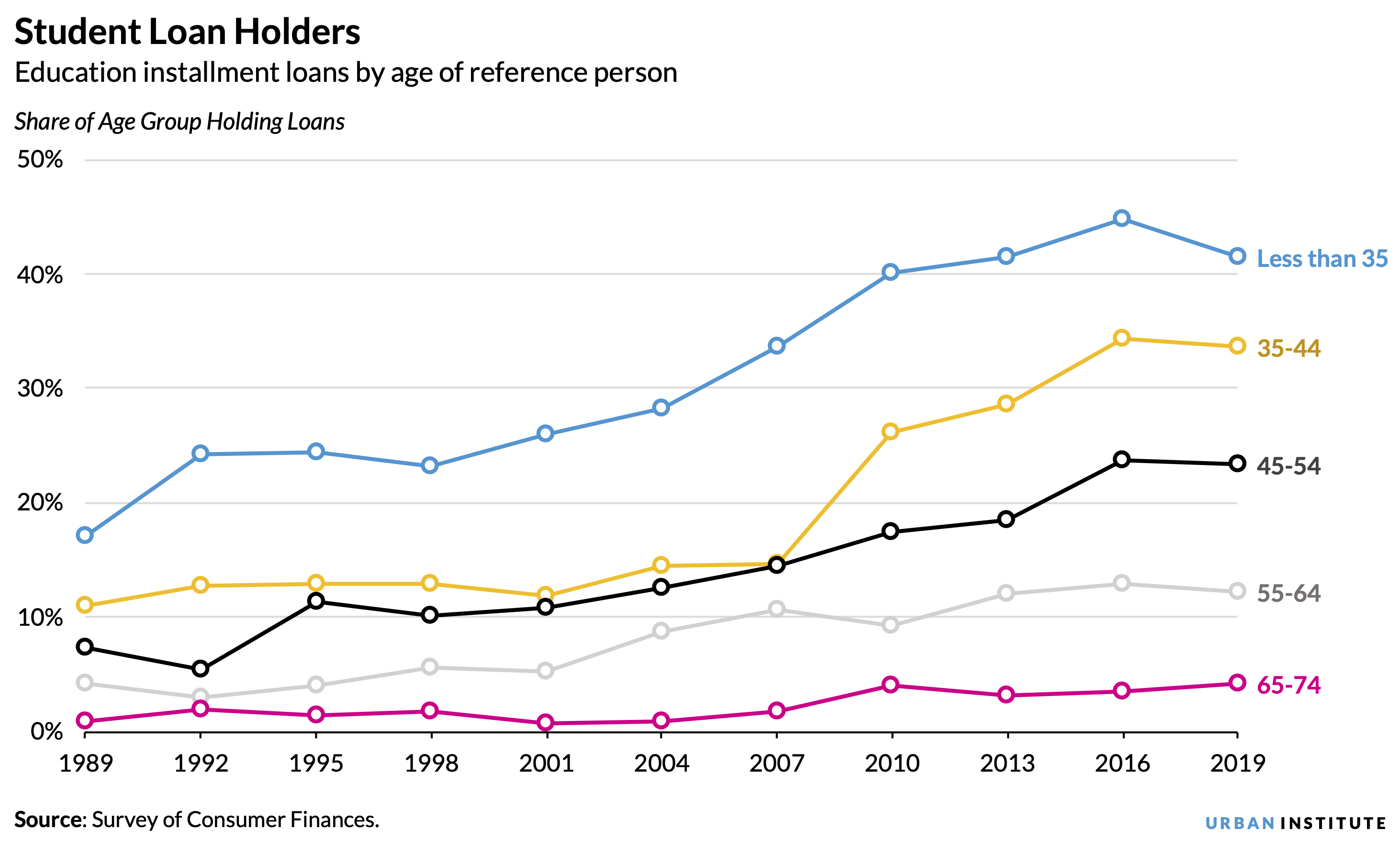

One notable trend is the rise in the age of student loan borrowers. The share of 35-to-44-year-olds holding student loan debt nearly doubled, rising from 15 percent in 2007 to 34 percent in 2019. This may be because of the increasing share of borrowers who are graduate students, in addition to some borrowers holding debts over long periods of time (PDF). And more parents are borrowing for their child’s education, with parent PLUS loan volume at public universities more than doubling between 2009 and 2019.

The composition of student loan borrowers as a group is changing in other ways too. Although the share of the US population with student debt has increased regardless of race and ethnicity, the median amount of student debt increased most for Black borrowers, surging from $11,360 in 2007 (almost $5,000 less than the median for white borrowers) to $30,000 in 2019 ($7,000 more than the median for white borrowers).

And unlike in the school year before the 2008 recession, first-year undergraduates from middle-income and higher-income households borrowed at roughly the same rate (PDF) as lower-income peers in 2015–16. This trend carries through to after students leave higher education as well. When we look at the share of households holding student loan debt in 2019, middle- and higher-income households (between 40th and 90th percentile of income) are roughly 8–9 percentage points more likely to hold debt than their lower- or higher-income peers, a trend that was less discernable (4–6 percentage point gap) in 2007.

Changes in student loan repayment policies

In addition to accounting for the changes in demographic composition of borrowers, new policy must account for how repayment options have changed. More generous income-driven repayment (IDR) policies were introduced in the years during and after the 2008 recession, such as Income-Based Repayment (2008, revised to lower payment share in 2010) and Pay As You Earn (2012). Borrowers are increasingly using IDR plans. The share of undergraduate borrowers in IDR plans grew from 11 percent to 24 percent from 2010 to 2017. Graduate borrowers went from 6 percent in IDR to 39 percent over the same period.

This policy change not only increases the amount of time borrowers take to repay their loans but also puts a sizable share of borrowers (more than 75 percent, in a 2012 cohort examined by the Congressional Budget Office) in negative amortization. Thus, the amount borrowers repay doesn’t cover interest, and student loan balances grow rather than shrink, even as borrowers make progress toward forgiveness.

Student loan debt and the next recession

Student loan borrowers are increasingly diverse, especially when it comes to economic need. There are substantial shares of student loan borrowers with low incomes who have trouble repaying their debt. And student loans can hamper wealth acquisition, particularly for Black borrowers, in a way that substantially contributes to growing racial gaps in household wealth. But student loan borrowers are considerably more diverse in age and income now than during the 2008 recession.

When planning for the next recession, policymakers may want to assess the diverse circumstances of borrowers and focus their efforts on helping those particularly at risk. For example, policymakers could focus on those on those already in delinquency or in default or target dollars towards addressing economic needs for all low-income families, such as through an expansion of social safety net benefits or additional stimulus payments. Addressing need directly could help ensure a more equitable recovery.

The Urban Institute has the evidence to show what it will take to create a society where everyone has a fair shot at achieving their vision of success.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.