Driven by the COVID-19 pandemic, a shaky recovery from 2020’s recession, and, now, the war in Ukraine, inflation has shot up in the United States and in countries worldwide. For Americans, recent dramatic surges in gas prices and rent have increased the costs of daily life at a quicker rate than wages.

Households with low incomes—who are disproportionately people of color—will likely be particularly affected by these changes. Most low-income workers—like most Americans—commute by car, and though electric vehicles are gaining popularity, few Americans currently have them, and those who do are relatively wealthier on average (PDF).

Moreover, families under the federal poverty level are much more likely to rent their homes than own them, exposing them to fluctuations in housing costs as landlords raise rents.

To address the needs of families with low incomes, policymakers at the local, state, and federal levels can develop short- and long-term strategies to address rising housing and transportation costs. These approaches could focus on efforts to stabilize rent, prevent evictions, and give people alternatives to driving, both by providing better options and by designing communities that prioritize pedestrians, cyclists, and transit riders.

What drastic increases in housing and transportation costs mean for people with low incomes

The US inflation rate reached 7.9 percent in February 2022, the highest level since 1982. Though inflation affected costs for consumers across a wide variety of daily needs, gas and rent are major areas of concern. Housing and transportation are the two largest expenditures for most households, often accounting for 50 percent or more of families’ overall spending.

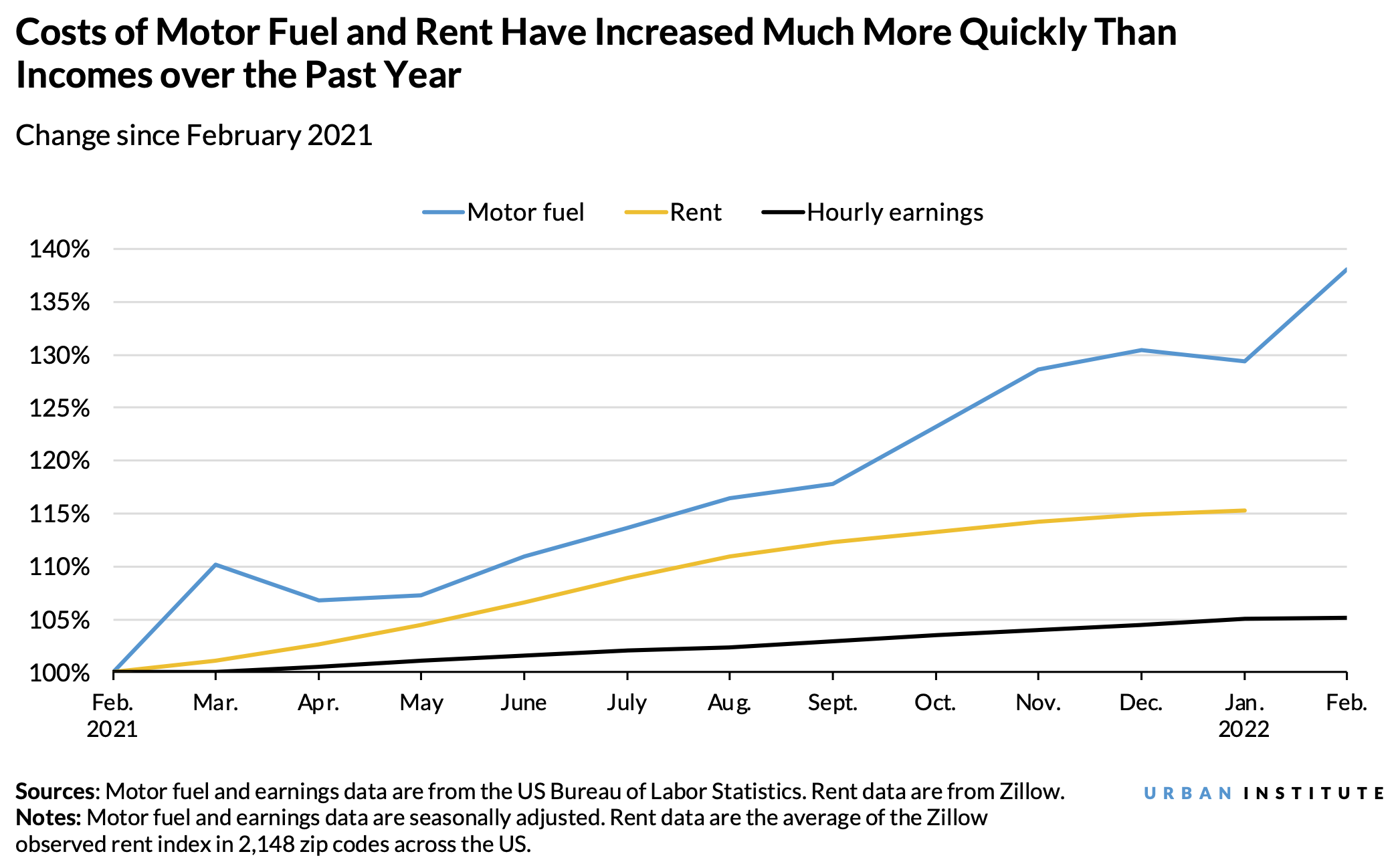

Between February 2021 and February 2022, gas costs increased by almost 40 percent, putting a heavy burden on the 76 percent of Americans who commute by car. By January 2022, rents in the average metropolitan area zip code had increased by about 15 percent—a major concern for the 36 percent of American households who rent. Each of these increases was far larger than that of hourly wages, which rose only about 5 percent over the past year.

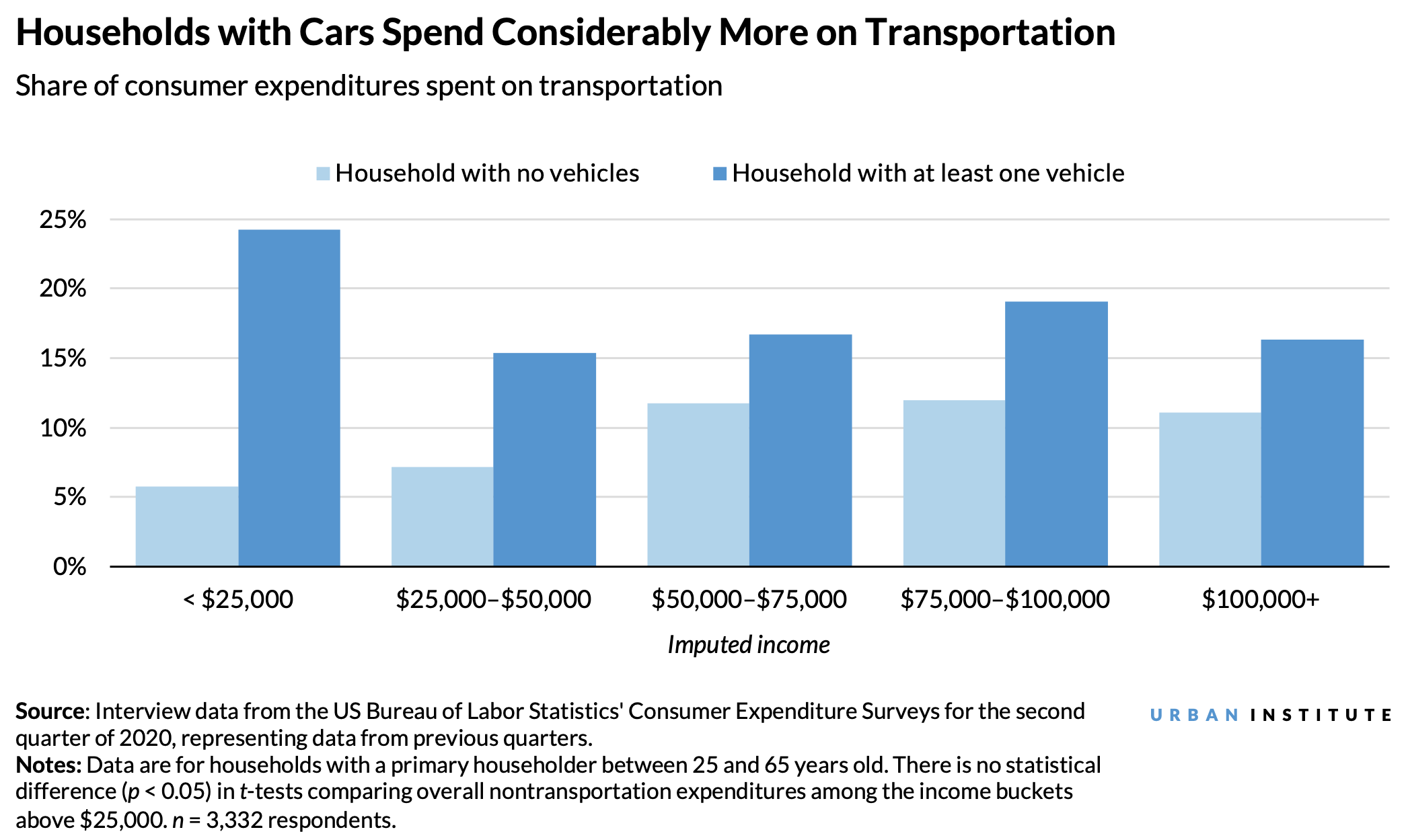

Transportation cost variations largely depend on whether people own and use cars. Across all income bands, households with no vehicles spend significantly less on transportation—including both daily travel and intercity travel, such as on flights—than those with cars. That’s especially true for families with low and moderate incomes.

According to survey data from 2020, among households with annual take-home pay of $25,000 to $50,000, families without cars only spent 7.1 percent of total expenditures on transportation, compared with 15.4 percent for those with cars. Households in those two groups spend statistically indistinguishable amounts on other expenditures, but those with cars spend thousands more per year fueling up their tanks and maintaining their vehicles.

In theory, Americans could shift away from cars and toward other options like walking, biking, and public transportation. But the reality is that most US residents live in communities where those options either are not available or are so difficult to use that they have little choice but to continue spending a lot on cars. And many families with low incomes simply cannot afford living in communities where walkability and transit access are easily available.

Inflation in gas costs is likely to worsen the situation, shrinking families’ budgets for other daily needs, like rent or food. These data suggest families with low incomes who rent their homes and are dependent on cars will be affected especially by inflationary trends. Rising rents could mean a higher likelihood of eviction. Rising gas prices could mean reduced or costlier access to employment, recreation, education, and other needs.

What strategies could ease cost burdens for people with low incomes?

Policymakers at the local, state, and federal levels have an opportunity to identify solutions that help families with low incomes in the short term while combating the conditions that expose them to inflation-related problems in the long term.

In the short term, some officials have promoted the idea of pausing the collection of federal and state gas taxes. Yet these taxes help pay for roadway maintenance, and pausing them is unlikely to reduce gas prices much, if at all.

Even if such a strategy reduced prices, it would incentivize more driving—a concern given automobiles’ large contributions to greenhouse gas emissions and continued roadway congestion.

Instead, policymakers could consider the following:

- Continuing to identify mechanisms to help renters remain in place by enacting policies to reduce evictions. Localities and states could target some of their unspent federal fiscal recovery funds and emergency rental assistance to keep renters housed.

- Reducing local transit fares, increasing bus service, and creating temporary street improvements for transit and biking that give people real alternatives to driving. This could ensure more people don’t have to rely on cars to get around.

- Significantly expanding the federal government’s Housing Choice Voucher Program. This deep subsidy for low-income renters could insulate people already living in apartments from steep rent increases.

Over the long term, policymakers can create mechanisms to ensure stability for families both in terms of housing and transportation costs. This means giving people opportunities to rent without fear of massive rent increases and giving them the option to move about their communities without having to rely on expensive, gas-guzzling cars.

This could mean the following:

- Creating new tools to promote rent stabilization and prevent displacement because of large rent increases. These tools can be designed to encourage new housing construction, rather than cutting off the supply of new homes.

- Redesigning local zoning codes to encourage more housing construction to reduce the pressures of demand on limited supply. This could reduce the possibility of sudden increases in housing costs as wages go up.

- Investing in new transit options, such as better bus and rail service, including by leveraging the funds available from the recently passed US infrastructure law.

- Planning for land use and transportation together to ensure communities don’t force people to drive for every need, while giving people easy-to-use, comfortable, and safe walking and cycling options.

Together, these strategies could help combat the ill effects of inflation now and in the future. If rolled out carefully, they could be especially useful in addressing the challenges faced by families with low incomes, who are most in need of support.

The Urban Institute has the evidence to show what it will take to create a society where everyone has a fair shot at achieving their vision of success.

Let’s build a future where everyone, everywhere has the opportunity and power to thrive

Urban is more determined than ever to partner with changemakers to unlock opportunities that give people across the country a fair shot at reaching their fullest potential. Invest in Urban to power this type of work.