Even with more Americans tackling systemic racism, including the Biden administration making racial equity a priority, the homeownership gap between Black and white Americans continues to grow, widening the racial wealth gap and other economic disparities. At all income levels, white households have a higher overall homeownership rate than Black households, and similar disparities exist when accounting for education. Black households that have a bachelor’s degree or an advanced degree are less likely to own their own home than a white household that lacks a high school diploma. Structural barriers may limit the benefits of education for Black graduates, who bear higher debt burdens, which may also affect homeownership. Even though overtly racist lending practices have been made illegal, their legacies persist in housing, contributing to a growing modern-day disparity.

If left unaddressed, the Black homeownership rate will continue to fall for every age group younger than 85, according to Urban Institute projections. As homeownership is key to building wealth—particularly for Black families, for whom homeownership makes up a greater share of household wealth than it does for white families—this trend poses an economic risk for the nation and a disaster for the Black families unable to achieve homeownership and transfer wealth to their children.

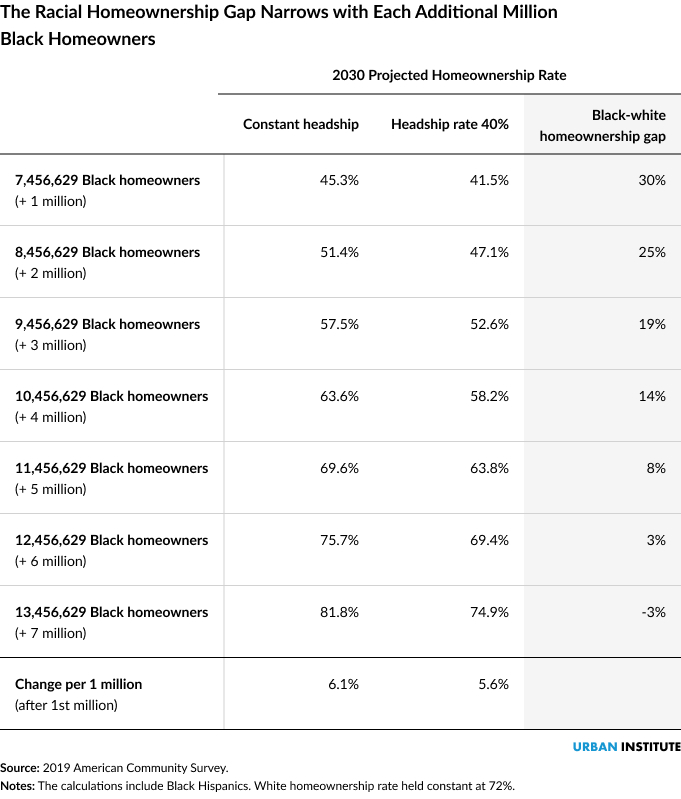

To increase homeownership among Black households, strengthen the middle class, and grow the economy, leaders in government, industry, civil rights, academia, and economic empowerment sectors need to unify around a shared goal that can provide a guiding light for defining and measuring progress. As part of these goals, we demonstrate in this blog post how each incremental increase of 1 million Black homeowners reduces homeownership gaps when accounting for projected population changes between now and 2030.

How incrementally increasing the number of Black homeowners affects homeownership rates

Nationally, the Black homeownership rate is 42 percent, compared with 72 percent for white Americans. These rates depend not only on the size of the population and how many households own a home but on the total number of households, which in turn depends on the rate of household formation.

In 2019, the Black population in the US totaled 42 million and resided in about 15.4 million households, and roughly 6.5 million of these households were homeowners. The US Census Bureau projects that the Black population will increase to 44.9 million by 2030. If the headship rate, the share of the population that is a head of household, remains flat, there will be only 16.4 million Black households. But our research suggests that the headship rate will increase. If the Black headship rate increases to 40 percent, there will be nearly 18 million Black households by 2030.

We projected the magnitude of incremental increases in the number of Black homeowners by 2030, assuming population growth and two scenarios of Black headship rates (constant and increasing to 40 percent). These projections indicate that surpassing the highest level of Black homeownership previously attained (49.7 percent in 2004) would require 3 million net new Black homeowners under the higher headship scenario. To reach the white homeownership rate (72 percent) would mean adding 6 to 7 million net new Black homeowners. Actual rates and gaps will vary depending on the Black and white populations and associated headship rates.

To meet this goal by 2030, policymakers and other leaders should invest in two important areas, according to our research.

1. Sustain current Black homeowners

Retaining and strengthening current Black homeowners is critical. The Great Recession dealt a blow to Black households and communities, who were disproportionately saddled with predatory loans, lost their homes at 1.8 times the rate of white borrowers (PDF), and lost a significant portion of their wealth. Tighter credit in response to the Great Recession (and perhaps a tightening housing supply) locked many Black households out of homeownership. The COVID-19 pandemic has dealt another blow, leaving Black borrowers more likely to be in forbearance or delinquent on their mortgages and once again at risk of losing their homes. Protecting these households and ensuring their meaningful recovery requires rethinking mortgage loss mitigation approaches and redressing structural factors that depress the benefits of Black homeownership.

2. Promote more new homeowners

A growing number of Black households will be in active homebuying ages (ages 25 to 54) through 2030. These younger cohorts are less than half as likely to own their homes as their white counterparts. Before the pandemic, there were already 1.7 million mortgage-ready Black households younger than 40 in the nation’s 31 largest metropolitan areas and more than 3 million such households nationwide. A focus on younger Black households represents a key opportunity to boost the Black homeownership rate.

Strategies to support new homeowners in lasting ways include structural changes in access to credit and financial resources, such as targeted down payment assistance programs, innovations in mortgage credit scoring and mortgage products, and counseling and education. Concurrently, a serious investment in the affordable housing supply, guided by the principles of equitable growth, is imperative.

None of these measures will work without a commitment to fair housing

Our nation’s history of explicit discrimination under federal law suppressed Black homeownership and has fueled the racial wealth gap. Absent government action to identify and remove discriminatory barriers to homeownership, even the most serious efforts to increase Black homeownership will fail.

Identifying achievable, actionable goals begins with understanding the history that has contributed to the racial homeownership gap and working to dismantle it. Any strategies to promote Black homeownership must begin with a commitment to fair housing and its consistent enforcement. We hope to assist stakeholders in designing strategies that shrink racial disparities in homeownership and increase homeownership opportunities for Black people still waiting to secure their piece of the American dream.

The Urban Institute has the evidence to show what it will take to create a society where everyone has a fair shot at achieving their vision of success.

Tune in and subscribe today.

The Urban Institute podcast, Evidence in Action, inspires changemakers to lead with evidence and act with equity. Cohosted by Urban President Sarah Rosen Wartell and Executive Vice President Kimberlyn Leary, every episode features in-depth discussions with experts and leaders on topics ranging from how to advance equity, to designing innovative solutions that achieve community impact, to what it means to practice evidence-based leadership.